retailers welcome opportunity to compete on level sales tax playing field

In big news out of Washington, D.C. this morning, the U.S. Supreme Court ruled in favor of a level sales tax playing field in South Dakota v. Wayfair. The case centered on a loophole in the law that allowed retailers without a physical presence in the state to avoid collecting and remitting state sales tax.

The Minnesota Retailers Association (MnRA) has long held the position that retail sales should be treated the same--whether in-store or online and regardless of the location of the retailer.

"It appears fairness is on a path to prevailing. Today's decision is a big moment for Minnesota retailers that have argued for sales tax fairness for years and years," said MnRA President Bruce Nustad in reaction to the news. "This is a great step in leveling the playing field and ensuring an online sale has the same tax treatment as an in-store sale."

"This issue has plagued retailers in towns across Minnesota as well across the country for years. Retailers welcome the opportunity to compete for customers on service, convenience and price, without a competitor having an unfair tax advantage," added Nustad.

In 2013 MnRA worked with the Minnesota Legislature and Governor to ensure retailers with a physical presence in Minnesota were collecting sales tax on their online sales, and in anticipation of today's decision the Association last year worked on remote-seller language to cover third-party marketplace transactions beginning July 1, 2019 or when a favorable decision was delivered (as it was today) by the U.S. Supreme Court.

With today's ruling, MnRA will take the next steps of analyzing the decision and continuing to work with our elected officials as well as the Minnesota Department of Revenue.

MnRA thanks the countless number of retailers that have worked on this issue over the years, as well as our legislative partners at the state and federal level.

Read the full decision here.

Written by Bruce Nustad

on Thursday, 21 June 2018.

Posted in Trends, Retail Operations, Policy & Politics

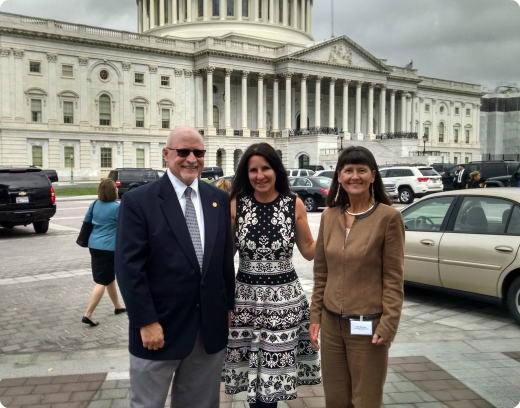

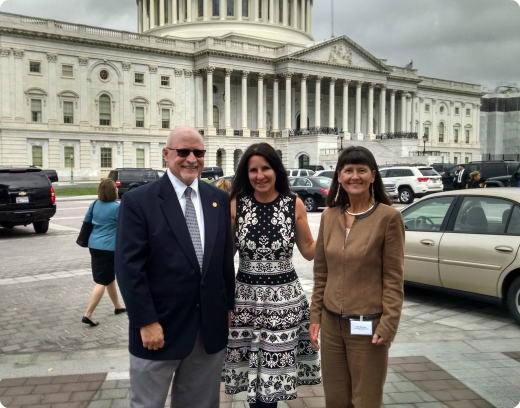

Games By James' Glenn McKee & The Border Adjustment Tax

Most small retailers don't have a moment to spare. And neither did Glenn McKee when he got the call about going to Washington, DC to talk with Minnesota's elected officials about the proposed border adjustment tax a month and a half ago.

But McKee, owner of several Games by James and Air Traffic stores, decided to take a few days away from running his business to tell his real life story about how the proposed high import tax would negatively impact his suppliers and ultimately his customers.

McKee's efforts and those of many other retailers produced important results last week when an influential group of legislators announced that the border adjustment tax had been dropped from the federal budget plan.

Following an initial visit to DC in June, McKee made a second trip a week later, and a third just two weeks ago to deliver the message that the border adjustment tax threatens to damage retailers of all sizes with noticeable impacts on communities across Minnesota.

"If you don't think one or two or three or 10 conversations can make a difference, try telling that to Glenn McKee" said Minnesota Retailers Association president Bruce Nustad. "The pressure to pass the border adjustment tax was tremendous, but voices like Glenn's made a made a huge difference in this conversation. We are so grateful to Glenn and others."

"In the beginning I questioned how my voice as a retailer in Minnesota could impact on this conversation", said McKee in reaction to the announcement. "But it turns out delivering the straight story and helping those that are elected to represent us understand this issue had a deep impact. I feel like I made a difference."

Glenn McKee, owner of Games by James and MnRA Board member, along with Devee McNally and Julie McAdam of Madesmart in front of the U.S. Capitol after paying visits to Minnesota's federal elected officials in opposition of the border adjustment tax.

Written by Bruce Nustad

on Monday, 31 July 2017.

Posted in Trends, Retail Operations, Policy & Politics

Employees & Employers Oppose Job-Killing, Consumer-Punishing Border Adjustment Tax

Americans for Affordable Products (AAP) – a collection of more than 400 businesses and trade associations seeking to stop the Border Adjustment Tax (BAT) – released the following statement in response to President Donald J. Trump’s tax policy unveiled yesterday:

“Retailers across Minnesota are encouraged by President Trump and his administration’s remarks yesterday on an approach to tax policy that excludes the ill-conceived Border Adjustment Tax. The Border Adjustment Tax concept is a job-killer to retail—one of Minnesota’s largest job-producing industries,” said Bruce Nustad, president of the Minnesota Retailers Association. “We are grateful the president has chosen not to increase the cost of basic necessities like gasoline, groceries, clothing and medicine. That approach would have hurt Minnesota’s consumers, families, and jobs.”

To obtain a full list of the AAP coalition, click here.

BACKGROUND:

Consumers Will Feel The Pain In Rising Costs From The Border Adjustment Tax:

Consumers Will Be Hurt By The Border Adjustment Tax Costing American Families As Much As $1,700. Upon passage, the Border Adjustment Tax or BAT will be slapped on everyday necessities costing American families as much as $1,700. (National Retail Federation, Accessed 1/31/17)

Border Adjustment Tax Threatens Largest National Employment Sector Representing One Quarter Of Americans:

PricewaterhouseCoopers LLP: Retail Is The Nation’s Largest Employment Sector Supporting 42 Million Jobs & Representing Employment For One In Four Americans. “Retail is the largest private-sector employer in the United States, supporting one out of every four jobs. A healthy and vibrant retail industry delivers a powerful impact across our economy … Retailers directly provide 29 million American jobs … The retail industry supports a total of 42 million jobs in retail and a host of other industries – 23.4% of total U.S. employment.” (National Retail Federation, Accessed 1/28/17)

Americans for Affordable Products is a coalition of job creators, entrepreneurs, business leaders and consumers united against higher prices on everyday necessities. To learn more, please visit: www.KeepAmericaAffordable.com.

Additional Information:

To schedule an interview with an Americans for Affordable Products representative, please email This email address is being protected from spambots. You need JavaScript enabled to view it..

Written by Bruce Nustad

on Thursday, 27 April 2017.

Posted in Trends, Retail Operations, Policy & Politics